State Taxes

A state is the highest level of the costing structure in payroll. Usually, it will refer to one of the states in Australia, although it can represent other locations such as an overseas destination. You must create at least one state.

If you use the General Ledger function in payroll, states can be part of your general ledger code structure. In addition, states are also used to track Payroll Tax liability. Within each state you can include different pay items in your payroll tax liability. The revenue office for your local state or territory can provide more information on your payroll tax obligations.

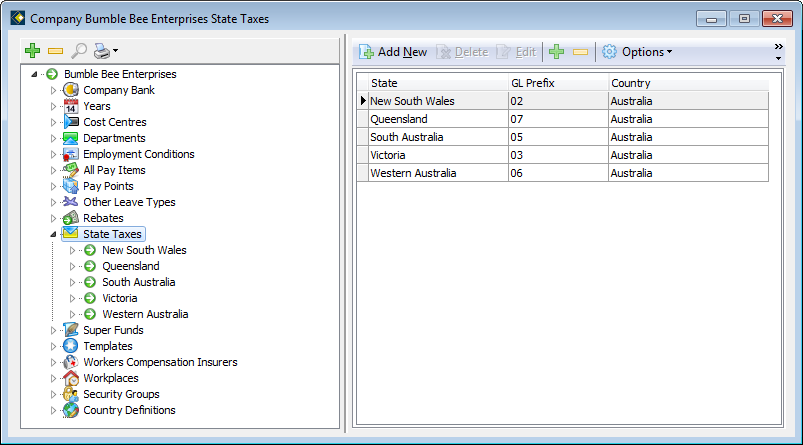

Opening the State Taxes file:

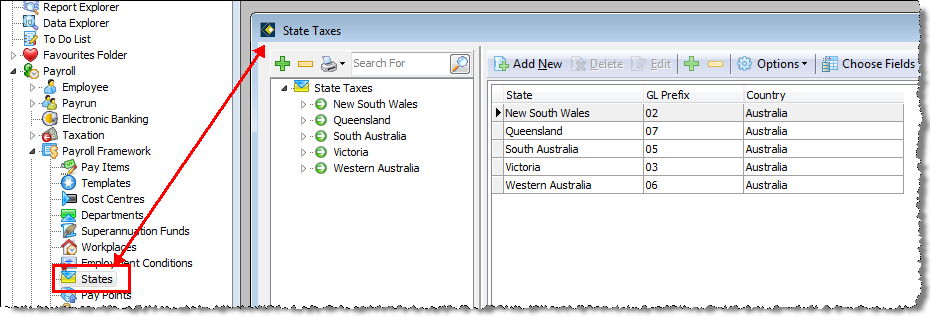

The State Taxes window (containing information related to States) can be accessed using one of the following methods. Note that both methods open the same State Taxes window:

- From the Navigator go to Company | Maintain company details.

- Select the State Taxes node

-- OR --

- From the Navigator select Payroll | Payroll framework.

- Double click the States node.

- To add a new state, first open the states file.

- Select the States node on the left.

- Click on the Add New button.

The State Taxes screen will open showing the Details tab at the front. - Complete the following information as required:

| Field Name | Explanation |

|---|---|

| State | Enter the name of the state which is going to be defined in this record. |

| Country | From the drop-down box select the country |

| Payroll Tax Definitions | |

| Taxation Reg. No. | Enter your taxation registration number (supplied by your state revenue office). This number identifies your company to the relevant revenue office and should be used in all communication with them. |

| Month Threshold | This is the monthly threshold for your company's wages bill. If your bill is below this amount, you may be exempt from payroll tax. The threshold may also be referred to as an exemption level, and differs from state to state. |

| Tax % | Enter the applicable payroll tax percentage rate for this state. |

| Account details | If this state provides the facility to pay payroll tax by EFT, enter the account details here. |

| BankStateBranch | Enter the BSB number which uniquely identifies the bank and branch of your company bank account from which the payroll tax will be paid. If you have entered a valid BSB, the bank and branch will display, otherwise click unknown to create a BSB. |

| Account Name | Enter the name of the account from which the payroll tax is to paid. |

| Account No | Enter the account number from which the payroll tax is to be paid. |

| LodgeRef | The lodgement reference will appear on the destination account to identify your payment. |

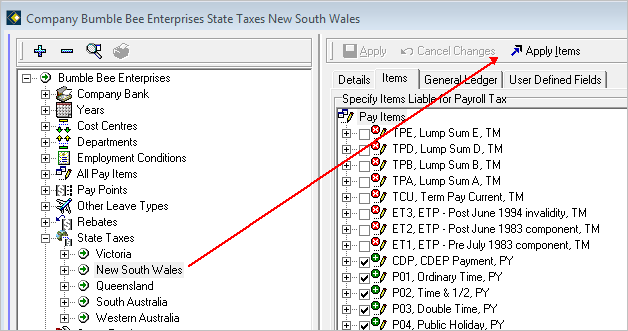

- If you will be using the state Payroll Tax function, select the Items tab.

- Select each item which is liable for state payroll tax.

- If you use the General Ledger function and State is part of your general ledger structure, select the General Ledger tab.

- Enter a prefix for this state.

- Click OK when ready.

Once you have defined the state payroll tax liability for one state, you can copy that definition to other states. Liabilities differ from state to state, but generally they are similar.

- Ensure the liabilities for a state have been defined correctly.

- With that State selected on the left, select the Items tab on the right

- Click the Apply Items button:

- The State Tax wizard opens on screen. Place a tick beside all states to which you wish to copy the current state's definition.

- Click Next when ready to apply the definition to the selected states. The wizard displays a list of all the states it updates.

- Click OK when ready.

- To edit a state, first open the States file.

- Select the States node on the left to display the details on the right.

- Edit any required details for the selected state, which may include the Items and the General Ledger tabs.

- Click OK.

General Ledger Prefixes

If you are using a general ledger structure which includes a State segment, you should define a general ledger prefix for each state. This prefix will be included in the State segment of the general ledger code generated from each transaction in this state. To enter the general ledger prefix for a state:

- Once the States file is open, select the State name on the left.

- Click on the General Ledger tab on the right.

- Using the example of your current definition as a guide, enter the required number of characters for your general ledger prefix. If you have not yet defined your General Ledger Structure, click on the Define Structure button to do it now. (See Using the General Ledger for more information.)

- Click Apply to see the state prefix reflected in the example.

- Once a state payroll tax liability has been defined, the State Payroll Tax Report is used to calculate the payroll tax payable.

- To run this report, open: System reports | Historical | Taxation.

- Two versions are available:

Summary which is a one-page report showing totals only.

Detailed which is a page-per-state. - Select the relevant payruns in the report filter

- Click Execute.